For individuals who possessed property between 2006 and 2011, there can be a good chance which you spotted the home’s well worth bitter regarding all the-big date levels to any or all-go out lows. In the 2012 alone, short sales taken into account 22 per cent of all household purchases.

What’s a short selling?

A primary sales is the revenue regarding a home where the fresh new continues try decreased to settle every mortgage balance resistant to the assets.

payday loans Fairfield University

If there is multiple lienholder towards the possessions, an initial and a second financial, such as, it’s important that all lienholders agree to undertake below the quantity due because the percentage-in-full.

Quick income wishing episodes depend upon the type of mortgage you find. As a whole, government-supported mortgage loans be more flexible than traditional home loan assistance.

not, there are numerous non-finest software that will accept you one day out-of property foreclosure if one makes a hefty advance payment and you will pay a higher mortgage speed.

Non-QM financial just after a preliminary product sales

Borrowing qualifying requirements getting non-QM fund will vary, but the majority of lenders give non-QM fund a single outing regarding a primary purchases.

Very non-QM loan programs hold highest interest rates and want big down payments. Consult with a low-QM home loan company on the certification criteria.

FHA: No wishing several months

FHA allows homeowners to try to get home financing immediately after an effective small profit. You should note, although not, one FHA’s zero waiting period features several tight caveats.

- You’re perhaps not during the default for the past financial on time of the quick selling, and

- On the 12 months before the brief selling, you have made your own mortgage repayments on time.

In case the mortgage was in default in the course of the newest quick sales, FHA need an effective three-12 months waiting several months before applying getting another type of home loan.

FHA mortgage after a preliminary business

- The fresh time of the brief purchases, Or

- In case your early in the day mortgage has also been an FHA-covered financing, from the day that FHA repaid the newest allege on quick deals.

If you possibly could inform you extenuating affairs caused the financial default, you will be able to qualify sooner than the 3-12 months several months.

- Separation and divorce (in certain cases)

- Serious disease or death of a close relative, always amongst the top salary earner, otherwise

- Business loss, once again usually between your no. 1 salary earner

Compliant financing once a preliminary sales

Homeowners trying place below 10 % down will demand to go to eight decades on date of its quick purchases.

You will find exclusions towards normal prepared periods to have a traditional financing. In order to qualify for this type of exceptions, you prefer the absolute minimum advance payment out of 10 percent, and written proof that short sale are the consequence of extenuating things.

Whilst not usually since the ruining due to the fact a foreclosures, an initial business could possibly get damage the credit. It depends on which your negotiate with your financial. Certain cannot report it whether your citizen helps make partial restitution to fund some of the lender’s losings.

Whether your brief product sales are reported while the a critical delinquency otherwise derogatory product, it can stay on their listing for as much as seven decades.

Tune the credit

Quick conversion always appear on your credit report as the Paid/closed with no balance. There will probably be also the notation, compensated at under complete harmony.

Possibly finance companies make this wrong and you can report small sales inaccurately. It is vital that the quick purchases is actually revealing towards credit bureaus truthfully.

Rebuild their borrowing from the bank

Fixing their credit relates to beginning brand new borrowing from the bank accounts and you will investing all of them promptly to have no less than 12 months. Continue all of the accounts unlock and you will pay them completely per month.

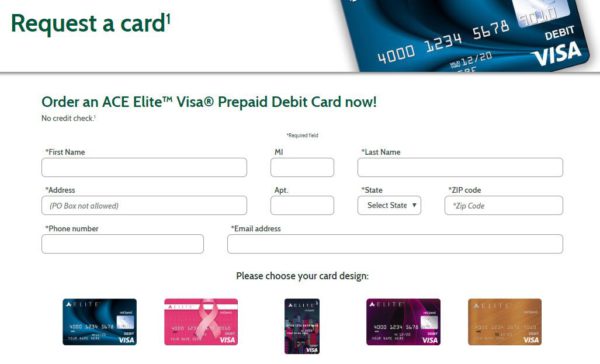

Covered playing cards are going to be a replacement for conventional borrowing from the bank notes. Choose one cautiously, even when. Specific just harvest high charge and offer nothing work with. Safeguarded notes only rebuild borrowing from the bank when they report your records in order to credit agencies.

You may improve your credit score as an enthusiastic subscribed user. Which means you have got friends otherwise family unit members that have excellent who happen to be ready to put one the profile because the a third party user.

Discover your credit score

Based on a recently available survey, 40 % regarding customers don’t understand the necessity of borrowing ratings in making borrowing choices.

There are certain activities that define your own borrowing ratings, such as percentage record, ages of membership, form of accounts and you can amount of borrowing concerns.

Exactly what are The present Mortgage Costs?

Regardless of if you’ve had a preliminary marketing on the modern times, you may still qualify for a minimal downpayment, a minimal rates, and the lowest month-to-month homeloan payment.

See current home loan cost now. Zero public cover number must start-off, as well as rates come with entry to your real time mortgage borrowing from the bank ratings.